Contribution Margin: What It Is, How to Calculate It, and Why You Need It

Contents:

In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10). If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10). Which of the following is NOT a correct definition of the break-even point? The point where total profit equals total fixed expenses. The point where total contribution margin equals total fixed expenses.

A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. In conclusion, we’ll calculate the product’s contribution margin ratio (%) by dividing its contribution margin per unit by its selling price per unit, which returns a ratio of 0.60, or 60%. In order to perform this analysis, calculate the contribution margin per unit, then divide the fixed costs by this number and you will know how many units you have to sell to break even. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000.

That means $130,000 of net sales, and the firm would be able to reach the break-even point. Level up your career with the world’s most recognized private equity investing program. The contribution margin is ascertained by deducting the…

How Do You Calculate the Break-even Point in Units with Contribution Margin?

Use the data file Food Nutrition Atlas—described in the book’s appendix—as the basis for your statistical analysis. You will first need to obtain a subset of the data file using the capabilities of your statistical analysis computer program. Prepare a rigorous analysis and a short statement that reports your statistical results and your conclusions. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

Other financial metrics related to the Contribution Margin Ratio include the gross margin ratio, operating margin ratio, and net profit margin ratio. These ratios provide insight into the overall profitability of a business from different perspectives. The degree of operating leverage is calculated as _______. Profit divided by contribution margin break-even sales divided by profit profit divided by break-even sales contribution margin divided by profit. Profit margin is the amount of revenue that remains after the direct production costs are subtracted. Contribution margin is a measure of the profitability of each individual product that a business sells.

Contribution Margin Formula

Because of this, a high sales volume has to occur before any profit is made. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail. Contribution margin is used to evaluate, add and remove products from a company’s product line and make pricing and sales decisions. Management accountants identify financial statement costs and expenses into variable and fixed classifications. Variable costs vary with the volume of activity, such as the number of units of a product produced in a manufacturing company.

Now let’s have an example; suppose company X sells tennis rackets. 10,000 tennis rackets are sold per annum at $200 per unit. Companies tend to make an optimal balance between increased cost of production and increased revenue. Looking at contribution margin in a vacuum is only going to give you so much information. By submitting this form, you agree that Planergy may contact you occasionally via email to make you aware of Planergy products and services.

- It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

- This could be caused by a number of different circumstances.

- For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage.

- Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels.

Alternatively, the company can also try finding ways to improve revenues. For example, they can increase advertising to reach more customers, or they can simply increase the costs of their products. However, these strategies could ultimately backfire and result in even lower contribution margins. If a company has high variable costs due to its net sales, it might not have to cover many fixed monthly costs. For example, if the price of your product is $20 and the unit variable cost is $4, then the unit contribution margin is $16.

What Is Contribution Margin? Definition and Guide

This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs.

- The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits.

- Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income.

- This may include items such as coffee beans, water, milk, disposable cups, and labor costs which total $4,000.

- However, to make effective use of the contribution margin ratio, it is vital to understand how and why it increases and decreases.

- Net SalesNet sales is the revenue earned by a company from the sale of its goods or services, and it is calculated by deducting returns, allowances, and other discounts from the company’s gross sales.

This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect costs and later for profit. Contribution margin analysis is a measure of operating leverage; it measures how growth in sales translates to growth in profits. Now that you understand contribution margin, we can move to a description of a contribution margin income statement. Look at the contribution margin on a per-product or product-line basis, and review the profitability of each product line. Selling products at the current price may no longer make sense, and if the contribution margin is very low, it may be worth discontinuing the product line altogether.

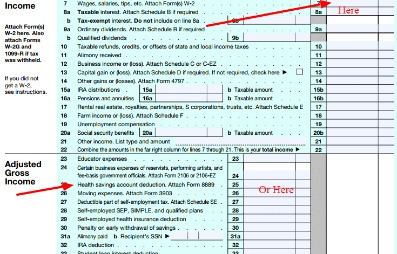

This is the net amount that the company expects to receive from its total sales. This revenue number can easily be found on the income statement. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement.

Teleflex Incorporated Receives Hold Rating from Brokerages … – Best Stocks

Teleflex Incorporated Receives Hold Rating from Brokerages ….

Posted: Tue, 11 Apr 2023 13:32:47 GMT [source]

Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. Contribution margin is a financial measure of sales revenue minus variable costs . CM is calculated overall or by each product and per unit. After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs.

budgeting report expenses are general costs that remain fixed, meaning they don’t change according to the production level, such as overhead oroperational costs. VCs are variable and inconsistent as they change andfluctuatedepending on the production level. Therefore, if we want to learn more about VC, we have to learn about the difference and relationship between VC and FC, which is fixed cost. Suppose the price of raw materials increases; the production cost increases. For example, 200 pieces of gold-plated jewelry can’t be made at the cost of 100 pieces of gold-plated jewelry.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Get instant access to video lessons taught by experienced investment bankers.

The contribution margin is the quantitative expression of the difference between the total sales revenue and the total variable costs of production of the goods that were sold. Variable costs fluctuate with the level of units produced and include expenses such as raw materials, packaging, and the labor used to produce each unit. The result of this calculation shows the part of sales revenue that is not consumed by variable costs and is available to satisfy fixed costs, also known as the contribution margin. If a company finds that its contribution margin is too low and it wants to generate higher profits, it needs to increase its contribution margin ratio.

Technip Energies Embraces Clean Energy Solutions But Backlog … – Seeking Alpha

Technip Energies Embraces Clean Energy Solutions But Backlog ….

Posted: Wed, 12 Apr 2023 12:23:13 GMT [source]

Best shown in both https://1investing.in/ and percent (Gross Profit/Revenue). The relationship between revenue and the cost to generate that revenue. In Cost-Volume-Profit Analysis, where it simplifies calculation of net income and, especially, break-even analysis.

Marathon Gold: Back On The Sale Rack, 2 Potential Catalysts … – Seeking Alpha

Marathon Gold: Back On The Sale Rack, 2 Potential Catalysts ….

Posted: Sun, 09 Apr 2023 08:44:56 GMT [source]

Variable costs, on the other hand, increase with production levels. The contribution margin is the amount of revenue in excess of variable costs. One way to express it is on a per-unit basis, such as standard price per unit less variable cost per unit.

The Completed Contract Method and ASC 606

Content

The method is used when there is unpredictability in the collection of funds from the customer. It is simple to use, as it is easy to determine when a contract is complete. In addition, under the completed contract method, there is no need to estimate costs to complete a project – all costs are known at the completion of the project. As a taxpayer in the construction industry, there are various accounting methods to choose from that will have an impact on tax-related cash flow over the life of your business. It is important for contractors to be aware of the methods and together with their tax advisors, determine which method best suits their business need and growth goals.

The information given regarding estimated completion costs was not needed in this problem. However, it is relevant if the percentage-of-completion method is used instead of the completed-contract method. Both under IFRS and GAAP, companies postpone tax obligations during the contract because they do not report profits. Under US GAAP and IFRS, companies can use this method when results cannot be measured reliably. However, both differ in recognizing revenue and expenses related to the contract. We are a company that hired a contractor to manage a renovation on a building that we purchased. We have received notices of liens against the contractor for our location.

Final Thoughts on the Completed Contract Method

In construction specifically, there are two exceptions to this rule. Since revenue reporting is postponed, tax liabilities are also deferred — sort of. The reduction of your business tax rates with expense recognition is also delayed. % Completed is determined as costs incurred divided by estimated total costs. An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period. At the end of year one, 50% of the project has been completed.

- If there is a loss during the completion of the project, then such losses are deductible only after project completion.

- Long-term contracts that qualify under §460 are contracts for the building, installation, construction, or manufacturing in which the contract is completed in a later tax year than when it was started.

- At the end of the construction, which ended up being 9 months instead of 8 months, the company pays the $5 million to WAY.

- We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions.

- As the costs for each contract are incurred, the contractor is essentially working towards the goal of completing the contract…and reaching their estimate of total costs for the job.

- On assets, the company eliminates the construction-in-progress account.

- To recognize the costs of the contract, they’ll credit Construction in Progress and debit their expenses.

At the end of 20X2, construction was 37% complete ($30,000 ÷ [$30,000 + $50,000]), so the revenue recognized for 20X2 was $37,500. At the end of 20X3, we know construction was completed because the estimated cost to complete as of the end of 20X was zero. Therefore, the $62,500 remaining revenue on the contract—$100,000 minus the $37, recognized in 20X2—was recognized in 20X3.

Percentage of Completion-Capitalized Cost Method

As the What Is The Completed Contract Method progresses, the revenues & expenses are accumulated in the balance sheet till the last day of completion of a contract. It is only after completion of the contract when the figures are moved from the balance sheet to the profit & loss account. You can observe from the above reading that the disadvantages of this method are more than the advantages. Thus, if you want a better picture of the contract status, the percentage completion method of accounting is upheld in all accounting standards, tax laws, etc. The completed-contract method will not reflect your yearly revenues, profits, or expenses in the period they’re incurred or earned.

What is the difference between percent complete and completed contract?

Under percentage of completion, a contractor recognizes project income and expenses as the project progresses, usually on a monthly basis. In contrast with percentage of completion, the completed contract method is used to recognize project revenue and costs only when the contract is complete.

The disadvantages of the completed contract method are that it can impact a business’s cash flow and working capital. It can also lead to unstable bottom lines, making it difficult to secure financial partners or bonding. Under the completed contract method, contractors only recognize revenue once all deliverables specified in the contract have been completed and delivered to the customer.

Journal Entries of Completed Contract Method

The language in US https://intuit-payroll.org/ for construction and production-type contracts are written in terms of options rather than prescription. If certain criteria are met, the percentage-of-completion method is used in US GAAP. If not, the completed contract method is used.

- Assume, the company incurs a cost of Rp220 in the first year and Rp80 in the second year.

- As the contractor won’t claim any revenue until the project is completed, tax liabilities are also deferred to the next tax season.

- If a contractor’s average annual gross receipts exceed $10 million then the Internal Revenue Service will consider that a large contractor.

- So, the laws of the country may require the contractor to follow the percentage completion method subject to few exceptions.

- This accounting can often lead to large fluctuations in reported revenue, as contracts can take months or even years to complete.

- As a result this method of accounting can pose some risks, one of which is a volatile bottom line.

The completed-contract method is used when costs are difficult to estimate, there are many ongoing small jobs , and projects are of short duration. This method can be used only when the job will be completed within two years from inception of a contract. Financial Statements Of The CompanyFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . Performance obligations are looked at by ASC 606 as opposed to contracts under completed contract accounting. Ensuring that your contract provides appropriate conditions for the transfer method ensures that you also take advantage of the tax deferral benefits.

What is the Completed Contract Method?

The advantages of the completed contract method are that it allows businesses to defer revenue and tax obligations until payment is assured. It also provides an accurate picture of a business’s financial health. Let’s say you are a contractor that has a $10,000 contract with 50% completion. You would recognize $5,000 of revenue under the percentage of completion method. Under the completed contract method, you would only recognize $2,500 of revenue since you have only completed 50% of the project. You shall make journal entries that are similar to when you are using the percentage of completion method.

INNOVATIVE SOLUTIONS & SUPPORT INC Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q) – Marketscreener.com

INNOVATIVE SOLUTIONS & SUPPORT INC Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q).

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]